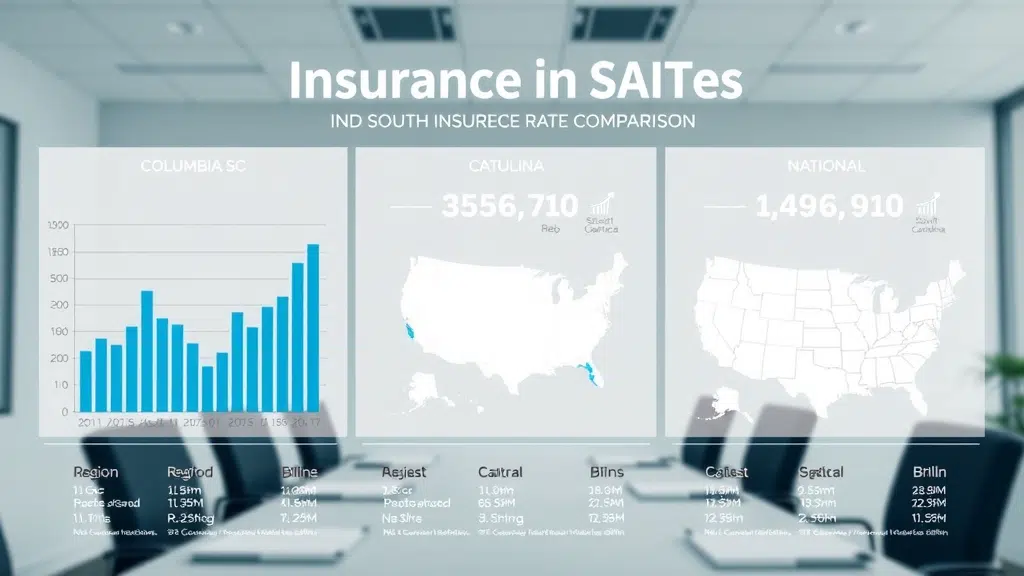

Did you know that Columbia, SC homeowners pay on average 12% more for insurance than the national average? If you’ve ever wondered why your insurance premium keeps ticking upward, you’re not alone. Understanding how to compare home insurance rates can help you save hundreds—sometimes thousands—of dollars each year, while ensuring your property and belongings are fully protected. In this comprehensive guide, we’ll break down the tips, strategies, and insider knowledge you need to compare home insurance options and find a policy that fits your needs and budget.

Startling Facts About Home Insurance Rates in Columbia SC

“Did you know Columbia SC homeowners pay on average 12% more for insurance than the national average? Knowing how to compare home insurance rates can save you hundreds each year.”

Columbia, SC is a vibrant, growing city, but compared to many U.S. metro areas, its residents face markedly higher home insurance rates. Multiple factors—ranging from the city’s risk-prone climate to its older housing stock and rising real estate values—drive up insurance premiums for homeowners. According to recent studies and sample rates, the average insurance premium in Columbia exceeds the national benchmark by over 12%. Considering factors like severe weather risk, claims history, and regional market trends, it’s no surprise that many residents are actively seeking ways to compare home insurance rates for greater savings.

Fortunately, residents aren’t powerless. By getting multiple home insurance quotes and using online comparison tools, Columbia homeowners have the power to shop smart, assess coverage limits, and switch to better-value providers. Taking just a few minutes annually to compare home insurance rates could save you a significant amount, improve your insurance coverage, and enhance peace of mind when the unexpected happens.

What You’ll Learn About How to Compare Home Insurance Rates in Columbia SC

- Why comparing home insurance quotes is crucial for Columbia SC residents

- How to analyze insurance quotes for the best insurance coverage

- Factors affecting your insurance premium and insurance rate

- How to use premium comparison tools smartly

- Key differences among home insurance companies

Understanding Home Insurance: Coverage, Quotes, and Policies

What Is Home Insurance and Why Compare Home Insurance Rates?

Home insurance—also called homeowners insurance—protects your dwelling, personal property, and liability from financial losses due to covered events like fire, theft, storms, and certain kinds of water damage. For Columbia residents, understanding each policy’s unique coverage options and comparing home insurance rates is critical. Different insurance companies offer a wide range of plans, premiums, and deductibles, which means failing to compare home insurance can leave you overpaying for less-than-ideal coverage.

A good home insurance policy includes dwelling coverage, personal property protection, liability insurance, and sometimes additional living expenses if your home becomes uninhabitable. But what you might not know is that premiums and policy terms can vary greatly depending on the insurer, your home’s location, your claims history, and even your credit score. Comparing insurance quotes—rather than simply renewing your current policy—lets you benefit from better rates, improved customer service, and coverage tailored to your evolving needs. By using a comparison tool or vetted insurance agent, Columbia homeowners can ensure they’re making informed, cost-effective decisions year after year.

The Components of a Home Insurance Policy

A standard home insurance policy includes several important components, each affecting your protection and the cost of your insurance premium. These elements typically include dwelling coverage (protects the structure of your home), personal property coverage (covers belongings like furniture, electronics, and clothing), liability protection, medical payments for guests, and coverage for additional living expenses if you’re temporarily displaced due to a covered loss.

It’s important to review each policy’s coverage limits and exclusions, as some providers may offer actual cash value (the current value minus depreciation) versus replacement cost coverage (the cost to replace items at today’s prices). Choose wisely based on your property type and personal risk tolerance—the difference can be significant following a disaster. By closely comparing these features across home insurance quotes, you ensure the best balance of price and protection.

Why You Should Compare Home Insurance Quotes Before Buying

- Better insurance coverage for your needs

- Lower insurance premium & reduced long-term costs

- Access to home insurance quotes from trusted insurance companies

Taking the time to compare home insurance quotes before purchasing or renewing coverage is one of the most effective strategies to prevent overpaying while ensuring sufficient protection. A premium comparison uncovers competitive rates and unique coverage features you may not know about. By evaluating multiple insurance quotes, homeowners discover opportunities for discounts, bundles with car insurance or auto insurance, and policies that actually fit personal property needs.

Not all home insurance companies are created equal—some prioritize low premiums, while others deliver superior customer service, flexible dwelling coverage, or generous liability limits. By comparing, you not only find savings but also avoid hidden exclusions and coverage gaps. Ultimately, it’s a step that translates into hundreds of dollars in savings and priceless peace of mind for Columbia families.

How to Compare Home Insurance Rates in Columbia SC: Step-by-Step Guide

Step 1: Gather Multiple Home Insurance Quotes Online

Begin your journey to lower costs by collecting home insurance quotes from at least three separate insurance companies. Leading comparison tools and insurance websites allow you to enter your property’s address, construction details, and coverage needs to receive instant, customized insurance quote options. This is the quickest way to compare home insurance rates side-by-side—no licensed agent or phone calls required unless you want direct advice.

Reputable online platforms aggregate insurance quotes from both national and regional companies. This means access to a wide range of sample rates, premium options, and discount programs tailored to your unique risk profile and zip code. Online quotes often reveal hidden fees, exclusions, or add-ons, helping you avoid costly surprises. Make sure to answer all questions honestly and consistently to ensure each insurance quote reflects your real-world scenario and mortgage company requirements.

Step 2: Examine Insurance Policy Features and Insurance Coverage

After gathering quotes, you’ll want to dive into the details of each insurance policy. Don’t be fooled by the lowest price—read the fine print around dwelling coverage, personal property coverage, liability limits, and exclusions. Some home insurance policies offer attractive pricing but come loaded with limitations on claims, high deductibles, or restricted protection for certain covered losses.

Pay special attention to: Coverage limits: Are the amounts high enough to rebuild your home or replace belongings in the event of a disaster? Deductibles: Higher deductibles can lower your premium but mean more out-of-pocket costs when you file a claim. Exclusions: Know what isn’t covered (e.g., certain types of water damage, mold, or natural disaster risks in Columbia SC). These details often separate a great deal from one that leaves you poorly protected.

Step 3: Conduct a Premium Comparison for Cost Savings

With core policy differences identified, it’s time for a premium comparison. Laying out the annual premiums, coverage types, and deductible levels in a simple chart gives you a clear snapshot. Look for patterns—does one insurance company routinely offer lower insurance rates for similar or better coverage? Have you factored in possible discounts, such as bundling with auto insurance or car insurance?

Keep in mind: the best home insurance quote balances price, comprehensive coverage, and reliable claims service. Shopping on cost alone can mean sacrificing protection when you need it most. The premium comparison table below shows how different choices play out in Columbia SC:

| Company | Coverage | Deductible | Annual Premium |

|---|---|---|---|

| Reliable Home Insurance Co. | Dwelling $250,000 | Personal Property $100,000 | Liability $300,000 | $1,000 | $1,380 |

| Palmetto Insurance Group | Dwelling $250,000 | Personal Property $80,000 | Liability $300,000 | $1,250 | $1,250 |

| Nationwide Secure | Dwelling $200,000 | Personal Property $60,000 | Liability $250,000 | $1,000 | $1,210 |

| Carolina Local Insurance | Dwelling $250,000 | Personal Property $100,000 | Liability $500,000 | $2,000 | $1,180 |

Factors That Impact Home Insurance Rates and Premium in Columbia SC

Property Location and Risk Assessment

Where your home is located in Columbia, SC plays a crucial role in determining your insurance rate. Neighborhoods with higher crime rates, greater risks of flooding, or proximity to fire-prone business districts will typically result in higher premiums. Insurers analyze sophisticated risk assessment data, property maps, and local trends to adjust home insurance quotes accordingly.

Additionally, homes situated near fire stations, with recent updates to wiring, roofing, and plumbing, can sometimes receive preferred rates or discounts. Understanding your precise risk level helps you compare home insurance rates accurately—and can prompt smart improvements that reduce your costs over time.

Homeowners Insurance History and Claims

Your history as a homeowner—including previous insurance claims, lapses in coverage, and even how many years you’ve held a policy—affects your current and future insurance rates. Insurance companies view frequent past claims as an indicator of higher risk, which can lead to higher home insurance rates or coverage exclusions.

Maintaining a clean claims record may unlock loyalty discounts or preferred status with insurers. When comparing home insurance rates, always provide accurate claims information, and ask about claim-free rewards or first-time buyer incentives.

Insurance Coverage Options and Deductibles

The more comprehensive your insurance coverage—and the lower your deductible—the higher your insurance premium tends to be. Policyholders in Columbia SC should carefully calibrate deductible levels for their risk appetite and financial buffer. For example, increasing your deductible by a few hundred dollars can sometimes yield double-digit savings on a home insurance quote.

Don’t forget optional add-ons, such as flood insurance (often recommended in some South Carolina zones), additional coverage for valuables, or identity theft protection. Comparing coverage features and deductible options side-by-side empowers homeowners to find the right balance for their needs without overpaying for unnecessary extras.

Comparing Home Insurance Companies: What Sets Them Apart?

Analyzing Customer Satisfaction and Financial Stability

Smart shoppers know that the best insurance company isn’t always the cheapest. Customer satisfaction—measured by claims responsiveness, billing transparency, and helpful support—should weigh heavily in your decision. Consult online reviews, Better Business Bureau ratings, and Department of Insurance reports on complaint ratios and market share to judge which providers stand out.

Equally important is the insurer’s financial strength. Reputable rating agencies like A.M. Best and Moody’s analyze insurance companies’ ability to pay claims, manage risk, and weather disasters. Always choose a company with strong financial grades—trustworthy enough to be there when disaster strikes.

Discounts and Bundling: Auto Insurance & Car Insurance

Most major home insurance companies in Columbia SC offer bundling discounts if you combine your homeowners insurance with auto insurance or car insurance policies. Bundling can mean up to 20% off your combined premiums, plus the convenience of a single deductible in the event of a catastrophe affecting multiple properties.

Many insurers also offer credits for security systems, smoke alarms, storm-resistant roofing, or loyalty status. When you compare home insurance rates, ask each provider about potential discounts and how to qualify—they can make a real impact on your annual costs.

“Not all home insurance companies are equal—comparing home insurance rates means more than just looking at price.”

Video Guide: How to Compare Home Insurance Rates Online Effectively

Want to see the process in action? Watch our explainer video for a friendly step-by-step visual guide to using online comparison tools, inputting your personal data, reviewing multiple home insurance quote options, and identifying key coverage differences—all tailored specifically for Columbia SC homeowners. Learn how to spot the best value and avoid common pitfalls in just a few minutes!

Home Insurance Rate Trends in Columbia SC: What to Expect

Recent Changes in Insurance Rates and Premiums

Over the past few years, homeowners insurance premiums in Columbia SC have risen due to factors like increased severe weather claims, rising construction material costs, and shifts in insurance company risk assessments. While this has resulted in higher average rates, those who actively compare home insurance rates frequently still find significant year-over-year savings.

Staying informed about industry trends gives you an upper hand and lets you time coverage changes strategically—for example, switching before renewal dates or after property upgrades can sometimes reduce your premiums dramatically.

How Home Insurance Rates Are Calculated

Insurance companies use a blend of algorithms and market data to calculate your home insurance rate, looking at property characteristics (age, size, construction type), location-specific risks (flood, hail, crime rates), your claims history, and even your credit score. Some policies account for actual cash value, while others offer replacement cost.

It’s vital to periodically compare home insurance rates, as changes in your status or the market can mean you’re eligible for lower premiums or better coverage. Using comparison tools and consulting a licensed agent will help ensure you get accurate, up-to-date rates tailored for you.

People Also Ask: Compare Home Insurance Rates in Columbia SC

Is there a website to compare home insurance rates?

Yes, several reputable websites allow you to compare home insurance rates in Columbia SC. Tools such as InsuranceShoppingExperts and others aggregate multiple insurance quotes, helping you find the most competitive rates tailored for your needs.

Who usually has the cheapest homeowners insurance?

The cheapest homeowners insurance providers in Columbia SC often include both large national insurance companies and reputable regional insurers. Always compare home insurance quotes to discover the most affordable option based on your specific circumstances.

Who is the cheapest insurance company for home insurance?

Insurance rates can change based on many factors. To find the cheapest insurance company for home insurance, request insurance quotes from several home insurance companies and conduct a premium comparison to ensure you’re getting the best rate for the coverage you require.

What is the 80% rule in home insurance?

The 80% rule in home insurance states that to receive full reimbursement for a covered loss, your home insurance policy must cover at least 80% of your home’s replacement value.

Top Tips to Effectively Compare Home Insurance Rates

- Get at least 3 home insurance quotes from different insurance companies

- Review policy details, deductibles, and exclusions

- Assess insurance coverage needs based on your property type

- Check customer reviews and claims satisfaction

- Regularly review and update your home insurance policy

Video Walkthrough: Making Sense of Your Insurance Quotes

Watch our second video walkthrough for a hands-on demonstration of interpreting your comparison dashboard. See firsthand how a homeowner couple assesses quotes, understands variations in annual premiums, and makes informed choices based on coverage differences and customer service ratings—all from the comfort of their Columbia SC living room.

FAQs: Compare Home Insurance Rates in Columbia SC

- How often should I compare home insurance rates?

It’s recommended to compare home insurance rates at least every year, or whenever major changes occur—such as home renovations, major life events, or after filing a claim. Regular comparison helps you ensure your insurance premium remains competitive and your coverage features meet your current needs. - What documents do I need for an insurance quote?

You’ll typically need your home’s address, construction year, square footage, current insurance policy details (if available), and any recent improvements or claims information. Having your mortgage company info handy may help speed up the process of getting accurate insurance quotes. - Are online home insurance quotes accurate?

Online home insurance quotes are generally accurate when you provide complete, truthful information. However, confirm all details with a licensed agent before finalizing your policy; discrepancies can affect your final premium or coverage eligibility. - How can I lower my insurance premium?

Bundle policies (such as auto and home), raise your deductible, install security features, and maintain a good claims record. Always compare home insurance rates annually for new discount opportunities or better-priced home insurance quotes.

Key Takeaways on How to Compare Home Insurance Rates

- Always compare multiple home insurance quotes for best value

- Understand the insurance policy and insurance coverage before deciding

- Keep up with changes in home insurance rates and premiums

- Choose reliable home insurance companies for lasting peace of mind

Ready to Compare Home Insurance Rates in Columbia SC?

“Act now—small steps today can lead to big savings tomorrow. Start your search for the best home insurance rates in Columbia SC here: https://insuranceshoppingexperts.com/homeowners-insurance/”

Conclusion

Don’t leave your peace of mind to chance—compare home insurance rates today, make informed choices, and protect your Columbia SC home with the best possible coverage at the lowest price!

Sources

- South Carolina Department of Insurance – https://insurance.sc.gov

- Insurance Shopping Experts – https://insuranceshoppingexperts.com/homeowners-insurance/

- National Association of Insurance Commissioners – https://www.naic.org/

- ValuePenguin – https://www.valuepenguin.com/homeowners-insurance/south-carolina

- PolicyGenius – https://www.policygenius.com/homeowners-insurance/south-carolina/

For homeowners intent on getting the best value, Insurance Shopping Experts – Columbia SC Insurance Agency offers tailored advice and an in-depth look at local insurance options, helping you navigate the specifics that impact rates in your area. You can also check out practical walkthroughs on their YouTube Channel – Insurance Shopping Experts, where you’ll find video guides on comparing insurance quotes step by step and making sense of different policies. If you’re serious about learning how to compare home insurance rates in Columbia SC and securing the best policy for your situation, these resources will give you both expert guidance and relatable, hands-on demonstrations.