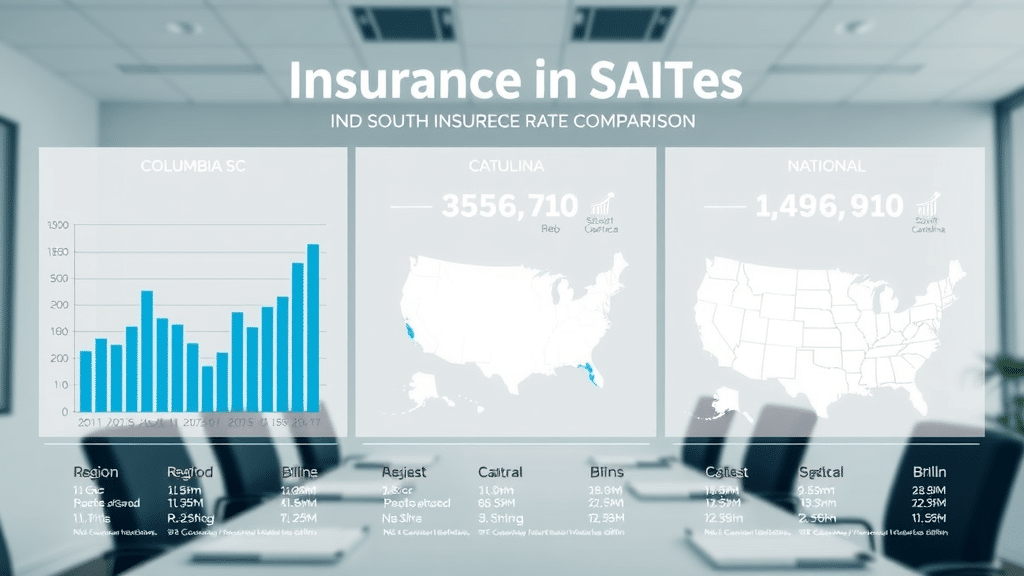

Nearly 1 in 8 drivers in South Carolina lack insurance coverage, making affordable insurance in Columbia, South Carolina more crucial than ever. Every day, residents and business owners risk financial setbacks by skipping or skimping on coverage—but finding the right policy at the right price is easier than you think. In this guide, we break down how local insurance groups, independent agents, and tailored coverage options can protect what matters most while saving you money. Read on for surprising facts, detailed provider comparisons, and expert strategies to land the best deal in the Palmetto State.

Surprising Facts About Affordable Insurance in Columbia South Carolina

“Nearly 1 in 8 drivers in South Carolina lack insurance coverage, making affordable insurance in Columbia, South Carolina more crucial than ever.”

Did you know that South Carolina ranks among the states with the highest proportion of uninsured drivers? This alarming trend not only puts motorists at risk, but it also impacts insurance costs for everyone—especially for car haulers, dump trucks, and tow trucks that rely on commercial protection. Local insurance agencies and groups in Columbia have crafted affordable insurance policies to address these unique risks, including garage liability and specialized business coverage for janitorial contractors or installation services. By partnering with independent insurance agents and trusted insurance groups, Columbia residents and business owners can access customizable, low-cost options that keep premiums down while maximizing protection. BBB accreditation and stellar customer reviews remain key signals of the best-value providers in the area, giving you even more confidence when choosing your next policy.

What You’ll Learn About Affordable Insurance Columbia South Carolina

- The key features and benefits of affordable insurance options available in Columbia, SC

- Comparisons of top insurance providers and insurance groups

- Strategies for finding the most affordable insurance group in the region

- Answers to frequently asked questions about insurance in South Carolina

Understanding Affordable Insurance Columbia South Carolina

What Is Affordable Insurance in Columbia South Carolina?

Affordable insurance in Columbia, South Carolina refers to insurance policies—whether they cover auto, home, business, or specialty risks—that provide reliable protection at competitive rates. The term “affordable” goes beyond just the monthly premium; it means striking a balance between price and coverage, ensuring your assets, vehicles (like car haulers, dump trucks, and tow trucks), and liabilities are safeguarded without breaking the bank. Local insurance groups and agencies actively tailor options to fit the specific needs of residents and business owners, from new drivers seeking cost-effective auto insurance, to self-employed janitorial contractors needing robust business profiles and garage liability. By leveraging independent insurance agents with access to multiple carriers, Columbia’s insured can receive personalized, unbiased recommendations that maximize value. BBB business profiles and yelp users’ reviews serve as additional resources, helping you gauge real-world satisfaction before committing.

Importance of Choosing the Right Insurance Group

Selecting the right insurance group in Columbia, SC can make the difference between paying too much for minimal coverage and securing comprehensive protection at a fraction of the expected cost. Groups with BBB accreditation and verified customer reviews often have established relationships with major insurance companies, allowing them to negotiate lower rates for specialized segments like dump trucks, car haulers, and janitorial contractors. They can also navigate the complexities of business owner information, making sure policies meet unique industry requirements. The best insurance groups will offer a variety of policy choices and work with independent insurance agents to provide true one-stop shopping. This approach gives both individuals and businesses access to insurance packages that reflect their needs—and not just corporate quotas. Comparing business profiles, consulting business owner reviews, and asking questions about garage liability or installation service add an extra layer of peace of mind as you shop for affordable insurance.

Benefits of Working With an Independent Insurance Agent

Working with an independent insurance agent in Columbia, South Carolina brings a host of benefits. Independent agents are not tied to one insurance company or exclusive insurance group, so their priority is matching you with the best-fit policy—whether you need auto insurance for a new car, commercial insurance for your janitorial contractor business, or garage liability for specialty vehicles like car haulers and tow trucks. Their local expertise is invaluable, with a deep understanding of how regional risks and state regulations affect premiums and coverage. These agents also have access to a wide network of providers, allowing more price and benefit comparisons, and they often score higher for customer service in reviews posted by local business owners. Furthermore, agents can help you identify discounts (like bundling auto and home policies) and provide clear, ongoing support for claims or policy adjustments, solidifying long-term value and personal trust.

Comparing Coverage: Affordable Insurance Group and Top Insurance Providers

| Provider | Coverage Types | Average Annual Price | BBB Accreditation | Customer Ratings |

|---|---|---|---|---|

| Affordable Insurance Group | Auto, Home, Business (dump trucks, car haulers, tow trucks), Specialty | $820 | Yes | 4.8/5 |

| Midlands Insurance Agency | Auto, Homeowners, Business, Installation service | $930 | Yes | 4.6/5 |

| Palmetto Insurance Brokers | Auto, Home, Janitorial contractor, Commercial Insurance | $860 | Pending | 4.4/5 |

| Southern Shield Insurance | Auto, Home, Specialty Garage Liability | $900 | No | 4.2/5 |

Review of Affordable Insurance Group in Columbia South Carolina

Affordable Insurance Group stands out in Columbia for its extensive range of policy options and local customer satisfaction. As reflected in BBB business profiles and customer reviews posted across various platforms, they provide specialized solutions for commercial clients like janitorial contractors, installation service providers, car haulers, and tow trucks. The group’s customer service is consistently rated as prompt and knowledgeable, with independent insurance agents addressing all questions—no matter how complex. With competitive annual prices, a history of reliable claim assistance, and strong local partnerships, the Affordable Insurance Group makes insurance accessible for everyone, from first-time homeowners to established business owners. Their BBB accreditation underscores their commitment to ethical business practices and transparency, making them a top pick for those seeking both coverage and confidence in South Carolina’s insurance landscape.

How to Compare Insurance Group Options Effectively

When comparing insurance group options in Columbia, start by outlining your specific needs: Do you require auto insurance for dump trucks or commercial vehicles? Are you a janitorial contractor or installation service provider with garage liability risks? Begin research by examining BBB business profiles, customer reviews, and independent insurance agent recommendations for each provider. Ask detailed questions about policy limits, add-ons, and customer service responsiveness. Request quotes from multiple providers—don’t just accept the first offer. Analyze not only the premium price, but also coverage types, deductibles, and available discounts. Look for groups with transparent owner information, BBB accreditation, and a reputation for resolving claims efficiently. Comparing real business owner feedback and using online review aggregators like Yelp helps ensure you choose a group that values your long-term financial well-being and provides personalized insurance coverage at an affordable rate.

Types of Affordable Insurance Columbia South Carolina Offers

- Auto Insurance (including dump trucks, car haulers, tow trucks)

- Homeowners Insurance

- Business insurance (janitorial contractor, installation service)

- Specialty Insurance

Columbia’s diverse insurance market meets a broad spectrum of needs—personal and commercial alike. Whether you’re a local family seeking reliable auto insurance to comply with South Carolina laws, or a business owner needing protection for specialized vehicles like tow trucks and car haulers, affordable insurance options are tailored for you. Providers understand the nuances of each policy holder, offering solutions for garage liability, homeowners insurance, or coverage for installation services and janitorial contractors. The best path to comprehensive, cost-effective protection is to work with local insurance groups and independent agents who understand the risks and regulations unique to Columbia and offer packages designed to deliver real savings and peace of mind.

Key Features and Benefits of Affordable Insurance Columbia South Carolina Plans

- Competitive rates for individuals and businesses

- Local expertise and personalized service from independent insurance agents

- Multiple insurance group options and packages

Competitive rates and personalized service are front and center in Columbia’s insurance offerings. Unlike generic online policies, local independent insurance agents provide tailored solutions—an advantage for commercial customers operating dump trucks, car haulers, or installation services, as well as homeowners and families. Multiple package options empower you to select the right blend of liability, property, and specialty coverage while accessing discounts for safe driving, security upgrades, and multi-policy bundling. The flexibility to pivot coverage as your needs change, combined with on-call support for claims and policy management, cements the value of choosing a Columbia-based affordable insurance group. Top-rated plans are often verified by BBB accreditation and reinforced by glowing customer reviews, giving you peace of mind about the provider’s integrity and responsiveness.

Steps to Get Affordable Insurance Columbia South Carolina That Suits Your Needs

- Assess your coverage requirements

- Research and shortlist top-rated insurance groups and agents

- Request personalized quotes

- Evaluate customer reviews and BBB accreditation

- Consult with an independent insurance agent

The process for securing affordable insurance in Columbia, South Carolina starts with clarity about your needs. If you own a vehicle, determine whether you need basic liability, full coverage, or specialized protection for dump trucks, tow trucks, or car haulers. Homeowners and business owners should consider risks like fire, theft, and liability—especially if you run an installation service or janitorial contracting firm. After setting your requirements, research insurance groups and independent agents with positive business profiles, BBB business accreditation, and top customer reviews. Request customized quotes, compare coverage details side by side, and rely on trusted agents to explain the fine print. Take time to consult with these professionals; their expertise can uncover discounts and package deals, ensuring you don’t overpay for coverage or overlook optional protections that could save you in the long run.

Customer Reviews: Affordable Insurance Columbia South Carolina Experiences

“Switching to an affordable insurance group saved me over $500 a year and provided better coverage for my business vehicles.” – Local Business Owner

Customer reviews tell a compelling story about the real savings and support found with affordable insurance in Columbia, South Carolina. Many business owners, from retail to service sectors, cite quick claims resolution, comprehensive garage liability options, and consistently helpful independent insurance agents as key reasons for high satisfaction. On Yelp and other platforms, users praise agencies for their attentive customer service and willingness to suggest an edit or tailor policies for evolving needs—especially in high-risk areas like dump trucks, janitorial contracting, and installation services. Verified reviews posted across multiple sites highlight transparent owner information, clear communications, and meaningful BBB business profiles as important differentiators. These firsthand experiences prove that working with the right insurance group pays off—not only in dollars saved, but in peace of mind and confidence that you’re always protected when it matters most.

People Also Ask About Affordable Insurance Columbia South Carolina

Who is the cheapest car insurance in SC?

Answer: The cheapest car insurance in South Carolina typically comes from regional providers focusing on affordable insurance in Columbia South Carolina. Insurance groups and independent agents can often secure the lowest rates, especially for good drivers and specialized vehicles like dump trucks or car haulers.

Who offers the most affordable insurance?

Answer: The most affordable insurance is offered by insurance groups and independent insurance agents in Columbia, South Carolina who can compare plans from major providers, such as those with BBB accreditation and strong local reputations.

Why is car insurance so expensive in South Carolina?

Answer: Car insurance rates in South Carolina are driven up by accident rates, uninsured drivers, and local claims history. Working with an affordable insurance group can help mitigate costs by offering discounts and targeted coverage.

What’s the best insurance in South Carolina?

Answer: The best insurance in South Carolina is one that balances affordability, coverage, and customer service. Independent insurance agents can help navigate options to ensure clients get the best affordable insurance in Columbia, South Carolina.

FAQs About Affordable Insurance in Columbia South Carolina

- How do I qualify for the most affordable insurance coverage in Columbia, SC?

Qualifying starts with a clean driving record for auto insurance and good claims history for homes or business. Compare quotes from insurance groups with BBB accreditation and consider bundling policies or taking advantage of discounts for security systems or safe driving programs. - What types of discounts are available with affordable insurance?

Many insurance companies offer discounts for bundled auto and home policies, multiple vehicles, installation of security features, safety training for business vehicles like dump trucks and tow trucks, and claims-free records. - Can I bundle auto and home insurance for more savings?

Yes! Bundling auto and homeowners insurance is one of the most effective ways to lower your total premium. Local insurance groups and independent agents in Columbia, SC can present package deals with extra savings. - Is BBB accreditation important when selecting an insurance group?

Absolutely. BBB accreditation signals a commitment to transparency and ethical practices. Profiles help verify business owner information and highlight customer reviews, which are critical in selecting a trustworthy provider.

Key Takeaways: Affordable Insurance Columbia South Carolina

- Affordable insurance in Columbia, SC, is available for all needs, from cars to businesses

- Comparing multiple insurance groups ensures the best rate

- Local agents offer personalized and independent advice

Conclusion: Secure the Best Affordable Insurance Columbia South Carolina Now

Take action today to protect what matters. Secure your affordable insurance Columbia South Carolina by contacting your trusted experts.

Your Insurance Experts https://insuranceshoppingexperts.com

Sources

- https://www.scdoi.sc.gov – South Carolina Department of Insurance

- https://www.bbb.org – BBB Accredited Insurance Providers in Columbia, SC

- https://www.naic.org – National Association of Insurance Commissioners

- https://www.yelp.com – Insurance Provider Reviews in Columbia, SC

When seeking affordable insurance in Columbia, South Carolina, it’s essential to explore reputable local providers that offer comprehensive coverage at competitive rates. One such provider is the Affordable Insurance Group, established in 1985, which offers a range of personal and commercial insurance solutions tailored to individual and business needs. (affordableinsgrp.com)

Another notable option is Midlands Insurance Agency, serving the Columbia area with various insurance products, including auto, homeowners, and business insurance. They are known for their personalized service and commitment to finding the best coverage options for their clients.

Exploring these local agencies can provide you with tailored insurance solutions that meet your specific requirements while ensuring affordability and comprehensive coverage.