Did you know the average cost for car insurance in Columbia, South Carolina, often exceeds the national average? For many families, that can mean hundreds—or even thousands—more each year simply for living in the Palmetto State’s capital! If you’ve ever wondered why your insurance cost is so high, how local laws and insurers impact your premium, or how to finally find the cheapest car insurance in Columbia SC, you’re in the right place. This comprehensive guide tackles your most pressing questions and empowers you with practical tools to start saving today.

Startling Facts About Columbia SC Insurance Rates and Costs

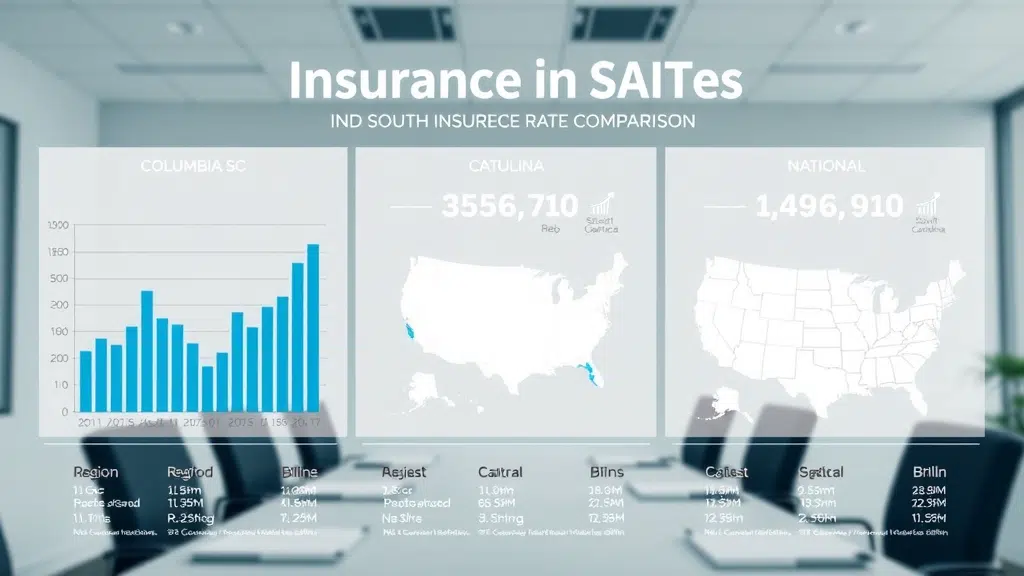

Columbia SC insurance rates are noticeably higher than in many communities across the US, with factors like urban traffic congestion, a higher frequency of claims, and unique local risks all driving up premiums. Recent studies report that the average cost for auto insurance in Columbia is roughly $80–$100 more annually compared to other parts of South Carolina. These differences can largely be traced back to a mix of high uninsured motorist rates, population density, and weather-related risks that affect homeowners premiums as well.

“The average cost for car insurance in Columbia, South Carolina, is often higher than the national average due to various local risk factors.” — Insurance Industry Expert

What You’ll Learn in This Guide to Columbia SC Insurance Rates

- How Columbia SC insurance rates compare to state and national averages

- Factors that determine car insurance and homeowners insurance costs in South Carolina

- The safest ways to lower your insurance premium in Columbia SC

- Tips to find the cheapest car insurance and best insurance companies

- Data-driven answers to the most common insurance questions

Understanding Columbia SC Insurance Rates: The Basics

What Are Columbia SC Insurance Rates?

Insurance rates in Columbia SC refer to the price you pay for your insurance policy, which covers auto, home, or other forms of protection. Unlike the state or national average, Columbia’s insurance rates reflect specific factors: urban traffic, crime statistics, weather incidents, and more. If you’re seeking car insurance or homeowners insurance, these rates are calculated according to your zip code, claims history, mileage, and the type of policy—like liability or full coverage. This combination means that two drivers living in different neighborhoods may see significant differences in their annual premium, even with similar backgrounds or vehicles.

By understanding what influences insurance rates in South Carolina—and in Columbia specifically—you’ll be able to make better choices about coverage. Insurance companies use specialized formulas, sometimes proprietary, to determine your risk. These reflect trends in driving record, likelihood of a speeding ticket or accident, property crime, and even your credit score. The result is that your insurance premium is unique to you but also closely tied to where you live in the greater Columbia area.

Average Cost of Insurance in South Carolina vs. Columbia

When comparing auto insurance and homeowners insurance costs, Columbia SC typically reflects higher figures than other regions of South Carolina. Recent data from insurance analysts shows the average cost of car insurance in Columbia is about $1,650 per year, while the statewide average falls closer to $1,450. The national average for similar coverage sits near $1,470, underscoring Columbia’s comparatively higher rates. Similarly, homeowners in Columbia pay an average of $1,640 per year—$120 higher than the South Carolina average and $250 more than other major US cities.

These differences can add up quickly, especially if you maintain both auto and homeowners coverage. Factors influencing these increases include a higher incidence of property claims, risk profiles attached to certain zip codes, and the area’s susceptibility to severe weather. Ultimately, whether you’re a new arrival to Columbia or a longtime resident, being aware of these statistics—and the factors shaping them—empowers you to shop smarter for your insurance needs.

| Columbia SC | South Carolina (Statewide) | National Average | |

|---|---|---|---|

| Auto Insurance (Annual) | $1,650 | $1,450 | $1,470 |

| Home Insurance (Annual) | $1,640 | $1,520 | $1,390 |

Car Insurance in Columbia SC: How Rates Are Calculated

Unlike a one-size-fits-all system, Columbia SC insurance rates for auto policies are sharply individualized. Insurers dig into your zip code, driving record, credit score, and what kind of car you drive. Each detail is run through statistical models—insurance companies tap into tools like Quadrant Information Services to determine the likelihood of filing a claim. Living in a neighborhood with more claims or property crime may increase your insurance premium, even if your driving history is spotless.

When applying for coverage, you’ll find terms like “full coverage” and “minimum coverage,” each offering different levels of liability, comprehensive, and collision protection. By law in South Carolina, you must meet the minimum requirements, but you may be better protected (and possibly lower your overall costs) if you bundle homeowners insurance or add specialized endorsements. Every item checked off on your application—such as accident history, past insurance lapse, or vehicle type—shapes your final insurance rate.

Key Factors Influencing Columbia SC Car Insurance Rates

- Zip code and neighborhood risk factors

- Driving record impact: speeding ticket and accidents

- Credit score and insurance premium

- Vehicle make/model and its effect on auto insurance rates

- Full coverage vs. minimum coverage needs

- Age and insurance costs

- Insurance company rate differences

Insurers heavily weigh your zip code, as some areas in Columbia report more vehicle thefts, accidents, or lawsuits, which leads to a higher insurance rate. Your driving record also matters—a clean history versus a recent speeding ticket can easily create a price gap of 40% or more. Moreover, a strong credit score typically means a lower insurance premium, as insurers see you as less of a risk.

The vehicle you drive is just as crucial; pricier models or those with high theft rates cost more to insure. Your age, too, will affect your car insurance rate—young drivers and those above 70 tend to pay more. Finally, the company you choose—whether State Farm, Progressive, or another insurer—will apply unique algorithms and risk assessments, creating significant differences in insurance costs.

How South Carolina Insurance Laws Affect Insurance Rate

South Carolina’s state laws directly shape the types and costs of coverage required. State-mandated minimums mean every driver must carry both liability insurance and uninsured motorist protection—a key driver of state-wide insurance costs. Additionally, insurance regulators oversee how companies calculate rates, set allowable discounts, and enforce consumer protections. These rules make it crucial to not only compare rates but also maintain continuous coverage to avoid legal penalties or forced high-risk insurance policies.

Recent adjustments in minimum liability and uninsured motorist requirements have led to modest increases—but also offer stronger protection. Insurers must offer certain add-ons, and consumers are often advised to consider options like underinsured motorist coverage to better safeguard against hit-and-run accidents and under-insured drivers, both of which are higher in Columbia than national averages.

Exploring Uninsured Motorist Coverage and Motorist Coverage Requirements

Uninsured motorist coverage is mandatory in South Carolina, including Columbia, due to the higher-than-average number of drivers without adequate insurance. This coverage acts as a safety net if you’re hit by a driver with no insurance or in a hit-and-run. State law requires you purchase the same minimums for uninsured motorist coverage as for liability insurance—meaning every Columbia driver is automatically protected up to these limits.

Motorist coverage can also include underinsured protection, a smart add-on for areas with a high rate of severe accidents or medical claims. While these requirements raise your insurance premium slightly, they offer crucial financial security if you encounter one of Columbia’s many uninsured—or underinsured—drivers. Carefully review your policy or speak with your insurer to ensure you meet all current requirements.

Role of Insurance Companies in Determining Your Insurance Premium

Insurance companies in Columbia SC use a sophisticated blend of your personal data, regional statistics, and statewide regulations to determine your insurance premium. While all insurers are regulated by South Carolina’s Department of Insurance, each company applies different weight to factors like past claims, driving record, zip code, and even preferred vehicle safety features. This means your insurance costs can differ dramatically from one provider to another—even when the coverage seems identical.

On top of that, insurers regularly review risk trends and update their pricing models, making regular comparison shopping one of the best ways to keep your rates in check. A company like State Farm may favor longstanding policyholders; another might give bigger discounts to new customers with safe driving records or excellent credit scores. Understanding how your insurer sets and revises your rates empowers you to ask the right questions—and demand the best value.

“Insurance rates are as unique as each driver’s profile. Careful comparison and an eye on local regulations will help you find the best policy in Columbia SC.” — Licensed Agent

Cheapest Car Insurance in Columbia SC: Who Offers the Best Rates?

If securing the cheapest car insurance in Columbia SC is your goal, start by comparing multiple providers. State Farm, Geico, Progressive, and USAA are consistently ranked as offering lower rates in the region, but their prices can fluctuate based on your driving history, credit score, and the type of car insurance coverage you select. Bundling policies and qualifying for safe driver or student discounts can also lead to significant savings.

The key is to get personalized quotes from several insurance companies and review the fine print. Some providers stand out for their handling of claims, online services, or specialized programs for low-mileage or high-tech vehicles. As rates can change annually—sometimes by several hundred dollars—even those who think they have the best deal should re-evaluate each renewal period.

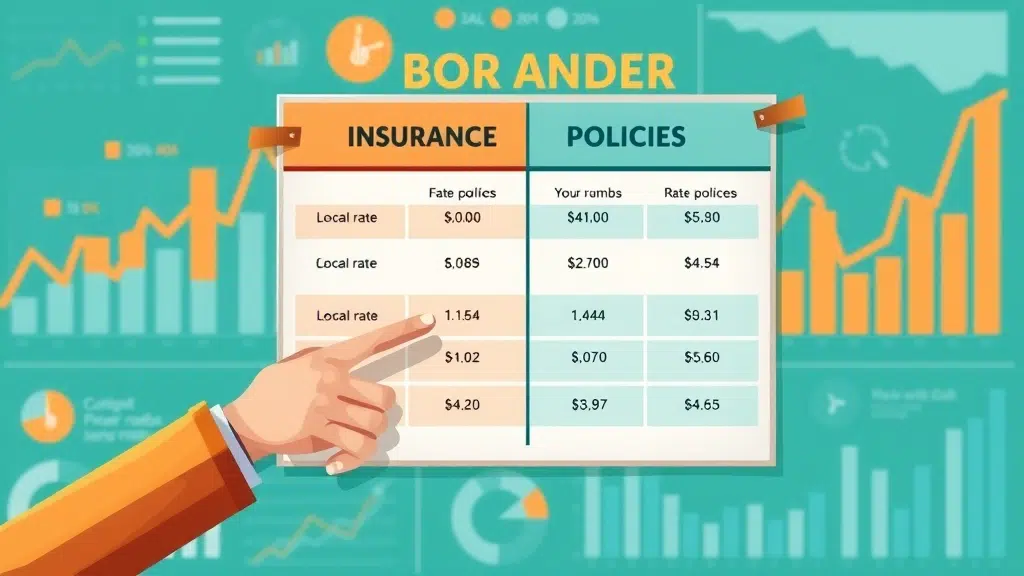

Top Insurance Companies for Cheap Car Insurance

| Insurance Company | Average Annual Premium | Coverage Options |

|---|---|---|

| State Farm | $1,320 | Full, Minimum, Bundled |

| Geico | $1,350 | Full, Minimum |

| Progressive | $1,390 | Full, Minimum, Specialty Vehicles |

| USAA* | $1,210 | Full, Minimum (Military and Family) |

| Allstate | $1,550 | Full, Minimum, Various Add-Ons |

*USAA is available only to military members and their families.

Comparing Insurance in South Carolina: Columbia vs. Other Major Cities

While Columbia has some of the highest insurance rates in South Carolina, other major cities like Charleston and Greenville also report slightly elevated premiums, especially for auto insurance. However, unique urban factors keep Columbia’s average cost a bit higher: more traffic congestion, higher instances of property crime, and a greater percentage of uninsured drivers. By contrast, rural regions of South Carolina often see insurance premiums 15–20% lower for equivalent coverage.

This means Columbia drivers must be extra vigilant—comparing car insurance rates, exploring bundling options, and periodically reassessing their policies to make sure they’re not overpaying. Tools like local insurance comparison sites or direct agent consultations can help highlight discounts not always published online, and they provide up-to-date data for your exact zip code.

How to Find the Cheapest Car Insurance: Insider Tips

- Comparison shopping for car insurance rates

- Understanding insurance cost factors

- Bundling home and auto insurance in South Carolina

- Asking for discounts based on driving record, credit score, and more

Savvy insurance shoppers in Columbia know that the process always starts with comparison shopping. Get quotes from at least three to five major insurers—each uses different pricing models for drivers with your profile, so the cost difference can be dramatic. Always be honest about driving history and consider factors like coverage limits, claims service, and optional add-ons when evaluating value.

Maximize savings by asking about discounts, especially for bundling policies (homeowners and auto) and for clean driving records or high credit scores. And if you’re a student, military member, or senior, many providers offer exclusive savings. Regularly reviewing your policy at each renewal and after major life events ensures you’re never missing out on emerging deals.

Full Coverage vs. Minimum Coverage: Which is Right for You in Columbia SC?

| Type | Average Annual Rate | Includes |

|---|---|---|

| Full Coverage | $1,900 | Liability, Collision, Comprehensive |

| State Minimum Coverage | $910 | Liability, Uninsured Motorist |

Pros and Cons of Each Coverage Level

Choosing between full coverage and the state minimum in Columbia SC is a decision that has financial and practical implications. Full coverage offers peace of mind with collision and comprehensive protection—it’s often required for financed vehicles and strongly recommended if you have a newer or valuable car. It also safeguards against the high out-of-pocket costs associated with theft, vandalism, or non-collision incidents, which are more common in certain Columbia neighborhoods.

Conversely, the state minimum keeps insurance costs low, making it a popular option for older cars or budget-focused drivers. Nonetheless, this choice comes with trade-offs: you could be financially responsible for repairs or losses exceeding your policy’s limits after a major accident. For some, minimum coverage is simply not enough—especially if you drive regularly in high-traffic parts of the city or have assets to protect. Always balance premium savings against potential future expenses.

How Insurance Rate Changes with Coverage Type

Switching from state minimum to full coverage can nearly double your insurance premium in Columbia, as shown in the rate table above. This jump is due to expanded protection—comprehensive and collision coverage cost more, as do add-ons like roadside assistance or rental reimbursement. However, the greater peace of mind and reduced financial risk can justify the extra cost if your vehicle or driving habits make you more susceptible to costly claims.

You can still control costs with higher deductibles, discount programs, and by reviewing which coverages truly match your risk. If your vehicle is paid off and older, minimum coverage might suffice. If not, investing in full coverage can be the difference between minor inconvenience and financial hardship after an accident.

Factors Beyond the Basics: What Else Impacts Columbia SC Insurance Rates?

- Insurance history and lapse in coverage

- Homeownership and bundling policies

- Claims history effect on insurance premium

- Usage-based auto insurance programs

- State Farm and other major insurer special programs

Several lesser-known factors can hike or lower your Columbia SC insurance rates. A gap or lapse in your previous coverage often triggers higher premiums, as insurers view you as higher risk. Likewise, frequent claims—even small ones—can increase your policy cost, while a “clean” claims history often qualifies you for claim-free discounts across most major insurance companies.

Homeowners can benefit from significant bundling discounts, so pairing your auto insurance with a home or renters policy in one place is almost always worth a look. Some insurers offer usage-based programs that monitor your driving habits—rewarding safe, low-mileage drivers with reduced insurance costs. State Farm and others frequently roll out regional initiatives or new digital tools, so it pays to ask about the latest savings opportunities the next time you review your policy.

People Also Ask: Columbia SC Insurance Rates FAQs

How much is homeowners insurance in Columbia, South Carolina?

Average Homeowners Insurance Cost in Columbia SC

The average cost for homeowners insurance in Columbia is about $1,640 per year, higher than the South Carolina average of $1,520, but still in line with other mid-sized metro areas in the Southeast. Rates depend on factors like home value, location, claims history, and whether you also bundle in auto insurance. Be sure to compare quotes for up-to-date, personalized pricing, as rates fluctuate annually and can differ between zip codes.

Does South Carolina have high car insurance rates?

South Carolina Car Insurance Rates Compared to National Average

Overall, South Carolina’s car insurance rates are slightly above the national average, largely due to higher rates of uninsured drivers, weather-related claims, and traffic density in its urban centers like Columbia. For state minimum coverage, drivers pay an average of $910, while the US average is about $880—demonstrating that in many areas, premiums in South Carolina, and especially in Columbia, are on the higher side.

Why is SC homeowners insurance so high?

The Unique Risk Factors Driving Up Insurance Costs

Several risk factors contribute to SC homeowners insurance being higher than neighboring states, including hurricane threats along the coast, flooding potential in central regions, and a relatively high volume of property crime claims in metro areas like Columbia. Additionally, rebuilding costs and supply chain challenges have led insurers to raise their premiums more aggressively in the past five years.

Who has the lowest insurance rates in SC?

Comparison of Insurance Companies with the Lowest Rates

USAA, State Farm, and Geico consistently offer some of the lowest auto insurance rates in South Carolina, especially for drivers with clean records and strong credit. USAA tends to have the cheapest rates but is limited to military members and families. For most residents in Columbia, comparing rates between these providers is often the easiest path to substantial savings.

Expert Tips for Lowering Your Columbia SC Insurance Rates

- Improve your credit score to lower insurance premium

- Shop for quotes from multiple insurance companies every policy renewal

- Bundle auto and homeowners insurance for bigger discounts

- Take a defensive driving course for a safe driver discount

- Adjust coverage to your specific needs—avoid paying for extras you don’t need

Key Takeaways on Columbia SC Insurance Rates

- Market trends show Columbia SC insurance rates are higher than in many parts of South Carolina

- Insurance rate can drastically vary by zip code, driving record, and insurance history

- Bundling and shopping for car insurance can result in considerable savings

- Re-evaluate your coverage every year to adjust for changes

Frequently Asked Questions: Columbia SC Insurance Rates

- Which insurance company is most popular in Columbia SC?

State Farm is consistently the most popular insurance company due to its extensive local network, personalized agent support, and competitive bundling discounts. - Are online insurance quotes reliable for Columbia SC?

Yes, most online quotes are accurate but always verify details with a licensed agent, as discounts and risk factors may vary by zip code or personal history. - How do claims history and insurance cost connect?

Multiple claims—especially within a short period—can significantly increase your future insurance rates. Some companies offer claim-free or accident forgiveness discounts.

Conclusion: Take Control of Your Columbia SC Insurance Rates Today

Summary and Next Steps for Finding the Best Insurance in South Carolina

Don’t let high Columbia SC insurance rates catch you off guard—compare your options, tap into discounts, and adjust your policy to match your unique needs. Your next step? Start with fresh quotes and a checkup of your current coverage.

“Savvy consumers in Columbia SC review their options each year, working with trusted insurance companies to keep rates as low as possible.”

Your Insurance Experts: Get the Best Columbia SC Insurance Rates Now

Ready to Compare Rates? Contact Our Insurance Specialists

- Visit: https://insuranceshoppingexperts.com

- Call or schedule a free consultation for personalized Columbia SC insurance rates assessment

Sources

- https://www.valuepenguin.com/average-cost-of-car-insurance – ValuePenguin

- https://www.bankrate.com/insurance/car/south-carolina/ – Bankrate

- https://www.insurance.sc.gov/ – South Carolina Department of Insurance

- https://insuranceshoppingexperts.com – Insurance Shopping Experts

- https://www.naic.org/ – National Association of Insurance Commissioners

To gain a deeper understanding of insurance rates in Columbia, South Carolina, consider exploring the following resources:

-

“Average car insurance cost in Columbia, South Carolina (From $164 a month)”: This article provides a comprehensive breakdown of car insurance costs in Columbia, highlighting factors that influence premiums and offering insights into finding affordable coverage. (insure.com)

-

“Average homeowners insurance cost in Columbia, South Carolina”: This resource details the average costs of homeowners insurance in Columbia, discussing variables that affect rates and suggesting strategies to secure the best coverage for your needs. (insure.com)

By reviewing these resources, you’ll gain valuable insights into the factors affecting insurance rates in Columbia and discover practical tips to potentially lower your premiums.