Did you know? Lexington drivers can pay up to 25% more on average for car insurance premiums than drivers just a few miles away—all because of local risk factors unique to the area. Understanding how car insurance rates are calculated in Lexington SC isn’t just a matter of formulas; it’s a combination of your driving habits, neighborhood risk profiles, and even the South Carolina weather. If you’ve ever wondered why your car insurance seems high or what you can actually do about it—this guide is for you.

A Surprising Look at How Car Insurance Rates Are Calculated in Lexington SC

Many Lexington residents are startled to learn that car insurance premiums are far from set in stone, even among neighbors with similar vehicles. Insurance companies use a blend of personal data, local risk profiles, and statewide regulations to arrive at your rate. Did you know even your ZIP code, proximity to high-traffic intersections, or a single speeding ticket can each trigger significant swings in your insurance costs? This section peels back the layers to reveal the variables—both obvious and hidden—that influence auto insurance rates in Lexington, SC. With insights from local experts and real comparisons, we demystify the process so you can make smarter, more cost-effective insurance decisions tailored to life in Lexington.

Whether you’re a seasoned driver with a pristine record or a family with a new teen behind the wheel, understanding the key ingredients in how car insurance rates are calculated in Lexington SC empowers you to spot savings opportunities and avoid surprises. In the next sections, we’ll break down the process, highlight unique Lexington factors, and provide actionable tips you can use right away to manage your car insurance premium.

What You’ll Learn About How Car Insurance Rates Are Calculated in Lexington SC

- Key components influencing car insurance rates in Lexington SC

- How insurance companies determine your insurance premium

- Local regulations and their impact on auto insurance costs

- Ways to save on your car insurance premium in South Carolina

- Common questions drivers have about insurance rates

Understanding Car Insurance Rates in Lexington SC

When you receive your policy renewal or a new car insurance quote, the number on the page often appears mysterious. But there’s a method to the math. In Lexington, SC, insurance companies evaluate a mix of local risk, your personal driving record, and your individual choices about coverage. The auto insurance premium you pay directly reflects perceived risk—both of you having an accident and of a costly claim being filed. Local factors, like traffic patterns at exits off I-20 or increased hailstorms, directly influence insurance premiums in this part of South Carolina. Understanding these local nuances is key, because what works to lower rates in other states or even neighboring cities might not apply here.

For example, South Carolina state law requires certain minimum insurance coverage (including liability limits for bodily injury and property damage), but local insurers in Lexington may look closer at your neighborhood’s crime rates, storm history, or even proximity to popular schools. These factors, along with your personal details and choices in car insurance coverage, combine to shape your unique car insurance rate. By understanding this process, Lexington drivers can make informed choices—like adjusting deductibles or seeking out eligible discounts—to manage their insurance costs over time.

Major Factors That Impact How Car Insurance Rates Are Calculated in Lexington SC

Driving Record and Incident History

Your driving record is one of the most influential elements in determining how car insurance rates are calculated in Lexington SC. If you have a clean driving record—free from accidents, traffic violations, or claims—insurers consider you a lower risk, often resulting in a lower car insurance premium. Conversely, incidents such as speeding tickets, at-fault accidents, or a DUI can lead to higher premiums or even limit your options to certain high-risk insurance companies. Each incident on your record typically stays with you for three to five years, so recent events carry the most weight.

It’s important to note that the cost of an insurance claim—whether for personal injury or property damage—also plays a role. If you’ve filed multiple claims within a short timeframe, an insurer may project a pattern and bump you into a higher risk tier. Even one serious incident can push your rates up, while a long period of clean, claim-free driving can unlock discounts. For Lexington families, regularly reviewing your driving history (and any young drivers’) is a key step in managing overall auto insurance premiums.

Location-Specific Risks and Lexington SC Traffic Patterns

Where you live and drive in Lexington can have a sizable impact on your car insurance rates. If you’re located near high-traffic corridors like Highway 378 or close to schools where congestion peaks during drop-off hours, insurers may rate your risk higher due to the increased likelihood of accidents or vehicle theft. Lexington’s periodic storms and propensity for hail also factor into higher-than-average insurance costs, as weather-related claims are more common here compared with inland or less storm-prone areas.

Additionally, certain neighborhoods in Lexington may have above-average rates of vandalism or auto break-ins—both of which affect individual and neighborhood-wide insurance premiums. Insurance companies use aggregate local data to predict the chances you’ll need to file a claim. That’s why two drivers with similar profiles but living just a few streets apart could see different rates, all based on location-specific statistics. As Lexington continues to grow, local risk factors and traffic patterns will remain at the heart of rate determination.

Vehicle Type and Insurance Costs

The type, age, and value of your vehicle are critical components in how car insurance rates are calculated in Lexington SC. For example, insuring a brand-new SUV loaded with advanced safety features but also high repair costs will generally cost more than covering a modest used sedan. Luxury cars, performance vehicles, and those with high theft rates typically generate higher premiums because repairs are expensive and risks associated with theft or damage are elevated. Conversely, vehicles with strong safety ratings and lower repair costs can lead to lower insurance premiums.

Insurance companies also factor in whether your car is leased, owned outright, or financed. If a lender or leaseholder requires full coverage—including comprehensive and collision coverage—your overall insurance cost rises. Drivers who opt for minimum legal coverage on older, less valuable vehicles will often pay less. However, keep in mind that lower-cost choices may increase out-of-pocket costs if you have to file a claim after an accident. In Lexington, practical vehicle choices tailored to your needs and risk profile can be a major source of savings.

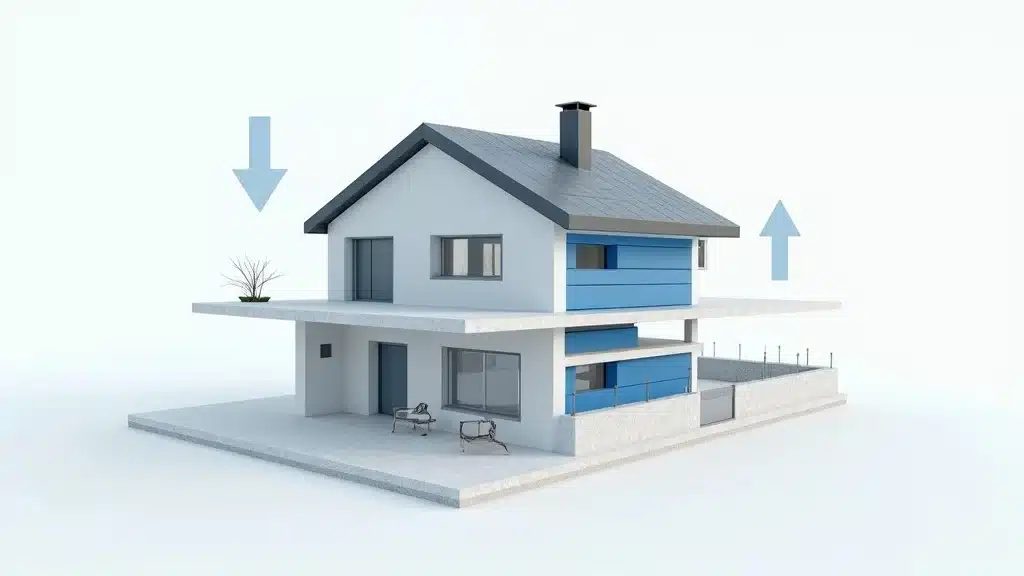

Coverage Options: Minimums vs. Full Coverage

The amount and type of insurance coverage you choose dramatically affects your car insurance premiums. South Carolina requires specific minimums for bodily injury and property damage liability, but many Lexington drivers opt for additional protections, such as full coverage. Full coverage expands your insurance policy to include collision and comprehensive coverage, safeguarding against theft, hail, deer strikes, and more. Choosing a higher deductible can lower premiums but increases out-of-pocket risk when you file a claim.

It’s also common to add endorsements or “riders” for roadside assistance, rental cars, or gap insurance (essential for newer or financed vehicles). Each add-on increases your auto insurance premium. Conversely, scaling back coverage, especially on older vehicles, saves money but also reduces your financial safety net. The decision should be based on your personal financial situation, vehicle value, and comfort with risk. In Lexington, local storm risks and high repair costs may make some form of comprehensive and collision coverage a smart investment—even if it means a slightly higher premium.

Credit Score and Financial Factors

Many Lexington drivers are surprised to learn their credit score can play a significant role in determining how car insurance rates are calculated in Lexington SC. Insurers view a higher credit score as a sign of financial responsibility, which correlates statistically with fewer claims. As a result, drivers with strong credit often pay lower insurance premiums, while those with lower scores may face higher premiums—sometimes by hundreds of dollars per year. This practice is legal and widespread across South Carolina, and virtually all insurance companies consider it in their pricing algorithms.

Other financial indicators may also be included, such as your history of late bill payments or outstanding debts. Improving your credit score—even modestly—can yield substantial savings on auto insurance premiums. Simple steps like paying bills on time, reducing credit card balances, and regularly monitoring your credit report not only improve your financial profile but could lead to lower insurance costs with your next policy renewal. In Lexington’s competitive insurance market, keeping tabs on your credit is a powerful tool for controlling auto insurance rates.

Personal Demographics: Age, Gender, and Marital Status

It’s no secret that insurance companies consider personal demographics such as age, gender, and marital status when setting car insurance premiums. In South Carolina, younger drivers—especially teens—typically pay the highest rates due to limited driving experience and higher accident risk. Males under 25 are usually quoted higher than females, although these gaps often narrow with age and clean driving. Married individuals also tend to see lower premiums, as statistical data links marital status to safer driving habits and fewer claims.

These demographic factors are largely out of your control, but certain strategies can help. For example, families in Lexington can often save by bundling policies or adding young drivers to an existing policy with established driving records. This also reveals why policy premiums often drop significantly after age 25 and after marriage. Ultimately, while you can’t change your age or gender, understanding their impact prepares you to compare options wisely or seek discounts where available.

Auto Insurance Companies and Local Regulations in South Carolina

How Insurance Companies Calculate Insurance Premiums

Insurance companies use sophisticated risk models tailored to your location, vehicle, and personal profile to estimate your insurance premium. While some elements are standard—like required coverage limits in South Carolina—many are hyper-local. These models weigh your driving record, claims history, vehicle type, and credit score against statistical data for Lexington. Factors such as frequency of hail claims or accident rates on roads like US-1 or I-20 are built into the algorithm, explaining why your auto insurance premium may differ from those in nearby towns.

Insurance companies also consider how likely you are to file a claim. The more claims, accidents, or violations you have (or your neighborhood averages), the higher the projected cost to insure you—resulting in higher insurance costs. By regularly reviewing insurer calculation methods and shopping around, you’re more likely to find a company whose risk profile matches your own driving habits and situation, keeping your premiums as low as possible.

South Carolina State Regulations and Their Effect on Insurance Rates

The state sets the ground rules for all car insurance policies issued in Lexington. South Carolina law mandates minimum liability coverage: at least $25,000 per person, $50,000 per accident for bodily injury, and $25,000 for property damage. These minimums guide how every insurer structures basic coverage—but local risk still shapes your final rate. For example, storm surcharges or “zone-based” rating factors may be layered onto the base premium for Lexington addresses due to the area’s storm and hail risk history. South Carolina also allows the use of credit score and does not cap how much rates can climb after a claim, making shopping around especially important.

Differing underwriting standards, discount offerings, and claims processing protocols among insurance companies—within the same regulatory framework—mean it’s essential for drivers to compare multiple insurance quotes before selecting a policy. Local regulations, while providing baseline protections, leave plenty of room for negotiation and possible savings with the right guidance.

Table: Comparing Car Insurance Premiums in Lexington SC vs. Other South Carolina Cities

| City | Average Annual Insurance Premium | Major Rate Factors |

|---|---|---|

| Lexington SC | $1,650 | High traffic density, storm risk |

| Columbia | $1,490 | Urban, higher theft rates |

| Charleston | $1,780 | Coastal, flood risk |

| Greenville | $1,420 | Suburban, moderate traffic |

List: Personal Actions That Can Lower How Car Insurance Rates Are Calculated in Lexington SC

- Maintaining a clean driving record

- Shopping for quotes from multiple insurance companies

- Adjusting coverage options

- Improving your credit score

- Taking defensive driving courses

- Bundling home and auto insurance policies

Quotes: Local Expert Insights on Car Insurance Premiums in Lexington SC

“In Lexington, unique traffic patterns and rapid population growth have a direct impact on local insurance premiums.” – Insurance Shopping Experts

“Many drivers don’t realize how much their zip code and credit score can influence their auto insurance premium in South Carolina.” – Local Insurance Agent

Watch our explainer video for a dynamic breakdown of local factors, insurance calculations, and insights from Lexington SC streets, weather, and insurance agents. This engaging visual resource helps make sense of everything you’ve read so far!

Hidden Costs: Lesser-Known Factors in Car Insurance Premiums in Lexington SC

Some of the highest costs in car insurance go hidden in the fine print. In Lexington, severe weather surcharges, windshield replacement clauses, or increased rates for particular professions may all impact your premium. For example, repeated claims for hail or flood damage in certain Lexington neighborhoods have pushed some insurers to add ‘catastrophic loss’ fees or require higher deductibles. Some drivers pay more due to specialized commute routes (such as long drives along the I-20 corridor) that are statistically linked to more frequent accidents or delayed response times after a crash.

Even a small claim for personal injury or comprehensive and collision coverage on a new vehicle could trigger a spike in your insurance cost next year. That’s why it’s crucial not only to understand your policy’s coverage, but also to regularly review and compare policies from different providers. These ‘hidden’ factors mean your insurance premium may change even if your own record stays spotless—so stay vigilant and stay informed!

Practical Example: Insurance Cost Calculation Breakdown for a Lexington Family

Imagine the Smith family, living in a residential area off Sunset Boulevard. Both parents drive daily to downtown Columbia for work, each with a good driving record, modest credit scores, and a pair of mid-range vehicles—one newer SUV with full coverage and one older sedan with minimum liability. They recently added their 17-year-old daughter to the policy. As soon as her name was added, their car insurance premium jumped by nearly $900 annually. Why?

Insurance companies calculated their new rate by weighing increased accident risk for teen drivers, Lexington’s local weather patterns (which led them to opt for comprehensive and collision coverage), and a slightly below-average household credit score. The Smiths shopped around, bundled their home and auto policies, and had their daughter complete a defensive driving course—ultimately reducing their annual increase by about $250. This real-world scenario shows just how much each factor can shift your rates, and why being proactive and informed is the Lexington way to save.

People Also Ask About How Car Insurance Rates Are Calculated in Lexington SC

Who has the cheapest car insurance rates in South Carolina?

While rates change often, some of the cheapest car insurance in South Carolina is typically offered by national companies like GEICO, State Farm, and Progressive, as well as local providers catering to safe drivers and multi-policy discounts. However, what’s cheapest statewide may not be cheapest in Lexington, where local claims history and risk profile are critical. Always compare personalized quotes from multiple insurance companies to find your true lowest rate.

What does $100k/$300k/$100k mean?

This common insurance shorthand refers to liability coverage limits: $100,000 maximum per person for bodily injury, $300,000 total per accident for bodily injuries, and $100,000 for property damage per accident. These limits are well above South Carolina’s basic requirements and offer robust protection—but may also increase your insurance premium compared to state minimums. Higher limits provide greater financial security, especially after a serious accident.

Why am I paying $400 a month for car insurance?

A $400 monthly premium is typically the result of one or more high-risk indicators—such as recent accidents, younger drivers on the policy, lower credit scores, high-value vehicles requiring full coverage, or living in a higher-risk Lexington neighborhood. Review your policy, check for eligible discounts, and compare with at least three other insurance companies. Simple changes—a defensive driving course, higher deductible, or improved credit score—could help reduce your monthly bill substantially.

Why is SC auto insurance so high?

South Carolina generally sees higher average auto insurance premiums due to a confluence of factors: recent storm frequency, elevated accident and claim rates, and relaxed regulatory frameworks that allow rapid rate increases after claims. Lexington amplifies these trends with local weather events, rapid growth, and dense traffic. Exploring your policy and risk profile can help you offset some of these higher premiums.

Don’t miss our exclusive interview with a local Lexington insurance agent—discussing real questions from residents, local rate pitfalls, and simple solutions for lowering your insurance cost. Access this video to hear straight from a trusted neighborhood expert.

FAQs: How Car Insurance Rates Are Calculated in Lexington SC

- What are the minimum insurance requirements in SC?

South Carolina requires a minimum of $25,000 bodily injury per person, $50,000 per accident, and $25,000 in property damage liability coverage. Uninsured motorist coverage matching these limits is also mandatory. - How does adding a teen driver affect my car insurance premium?

Adding a teen increases your premium significantly—sometimes by 50% or more. Teens are statistically more likely to be involved in crashes. Many insurers offer “good student” or safe driver discounts to help alleviate this cost. - Does my insurance cost change if I move within Lexington SC?

Yes. Even a move within Lexington can change your insurance rate if you end up in a neighborhood with different historical claims or theft rates. Always update your address and request a new quote when you move. - What discounts are available on car insurance in Lexington SC?

Common discounts include multi-policy bundling, defensive driving courses, good student, accident-free, and anti-theft device discounts. Check with your agent for all available savings relevant to your profile.

Key Takeaways: Understanding How Car Insurance Rates Are Calculated in Lexington SC

- Numerous personalized and local factors affect your insurance rates

- Shopping around and maintaining a clean record is key for lower insurance premiums

- Knowing how insurance companies calculate premiums empowers smarter choices

- Lexington SC has unique risk factors not seen statewide

Ready to See How Your Car Insurance Rates Are Calculated in Lexington SC?

Compare quotes now – Car Insurance In Lexington SC

Sources

- South Carolina Department of Insurance – https://www.doi.sc.gov/

- ValuePenguin – https://www.valuepenguin.com/car-insurance/lexington-sc

- Insurance Shopping Experts – https://insuranceshoppingexperts.com/lexington-sc-car-insurance/

- Bankrate – https://www.bankrate.com/insurance/car/south-carolina/

Understanding how car insurance rates are calculated in Lexington, SC, involves considering various factors, including local risk profiles, driving records, and vehicle types. To gain deeper insights into these elements, consider exploring the following resources: “Average Car Insurance Cost in South Carolina (2026) | Insurify”: This article provides a comprehensive overview of average car insurance rates across different South Carolina cities, including Lexington, and discusses factors influencing these rates. (insurify. com) “Cheapest Car Insurance in Lexington | (From $26 Monthly)”: This resource offers detailed information on how various driving violations can impact car insurance premiums in Lexington, SC, and provides insights into obtaining affordable coverage. (way. com) By reviewing these resources, you can better understand the specific factors affecting car insurance rates in Lexington, SC, and identify strategies to manage your premiums effectively.

Video Review:

Video Review: